Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Welcome to our series on crushing your credit card debt. In this third of five articles, we look at how to supercharge your get out of debt program with the Debt Snowball.

We’ll cut right to the chase: using the debt snowball method can save you thousands of dollars in interest payments. On top of that, it can also significantly reduce the time it takes you to get out of credit card debt.

The debt snowball is a method for paying down any debt–not just credit cards–and it’s extremely easy to use. Let’s take a look at how it works.

What is the Debt Snowball?

The concept behind the debt snowball is really simple. You’ll focus on one debt at a time until it’s paid off. Once you close out that first balance, you’ll “snowball” the amount you were paying into the payment for the next debt in line.

There are a few steps to follow to get the ball rolling, though (pun intended).

Step 1. Figure Out Your Total Debt

Before you can determine where your debt snowball should focus–and what you can expect from the process–you need to know where you stand.

First, make a list of all of your credit card debts. You can include other debts as well, such as school loans, auto loans, and home equity loans. The goal is to get all your balances in one place, where you can see your total debt. If you don’t have a comprehensive list of all your debts, check your credit report. It should include any debts with an outstanding balance.

Step 2: Figure Out the Specifics

For each debt, you’ll then want to figure out the specifics of the account. You should list the creditor, the outstanding balance to date, the monthly minimum payment, and the current interest rate. If you’re paying an introductory rate on the debt that will change after a certain time period, write that down, too.

Step 3: Figure Out What You HAVE to Pay

Even though you’ll focus on one account at a time with the debt snowball, you can’t simply neglect the others. Each debt will have its own unique minimum monthly payment. This amount is due each and every month in order to keep the account in good standing.

You’ll want to add up the minimum monthly payments due across all of your accounts. You will continue to pay at least this amount until all of your debts are paid in full. That means that when the first debt is paid in full, you’ll take the money you were paying toward that debt and focus it toward the next debt. For all other accounts, continue paying the minimum monthly due.

Step 4: Order Your Debts

The classic debt snowball order is to pay off your lowest-balance debt first. Start with the lowest balance and work your way up. This is a psychologically effective method because it gives you a few quick wins up front. In fact, some research shows that this option gets people to stick with their debt repayment plan for longer.

The other method of ordering your debts is known as the debt avalanche. This has you start with your highest-interest debt first. This plan saves you more money over time, since you knock out the debts with the heftiest interest first. But this may mean it takes longer to pay off the first debt on your list.

Either method can work well as long as you stick to it. But the key is to tackle your debts with a plan, and to always know which debt you’re planning to pay off next.

Step 5: Put Extra Money into the Snowball

If you have any extra money to put towards paying off your debts, add that to the minimum payment on the first debt each month. Once that debt is paid off, put both your extra money and the original debt’s previous minimum payment towards the next debt. This way your payments snowball, building momentum as you pay off each debt.

Why Does it Work?

Two things make the debt snowball a powerful tool. First, the minimum payment on a credit card goes down as the balance goes down. Most credit cards calculate the minimum payment as a percentage of the outstanding balance. While the actual percentage applied by credit cards varies, a range of two to four percent is common.

That means that after just one payment, your minimum payment will go down the next month (assuming you haven’t added any charges to the card). By keeping your payments constant, however, more and more of each month’s payment will go toward your balance instead of interest.

Second, as one loan is paid in full, you put the extra money toward another balance. This further accelerates the paying of your total debt, without actually requiring any additional funds from your end.

When the next account is paid in full, you will take the extra cash each month and put it toward your third card. Keep following this approach until all of your debt is gone.

How Much Does the Debt Snowball Really Save?

To see the power of this approach, let’s look at an example. We’ll assume that you have the following three credit cards with balances:

| $2,000 | 10% | $40 |

| $5,000 | 15% | $100 |

| $10,000 | 20% | $200 |

We’ve also assumed that the minimum payment is calculated by taking 2% of the outstanding balance. With these assumptions, the current minimum payment for all three cards combined is $340.

Minimum Payment Approach

Now, if you continue to make just the minimum payment each month, that amount will slowly go down as your balances go down. With that approach, how much will you pay in total interest and how long will it take to pay off the balances in full? I hope you’re sitting down for this:

- Total Interest Payments: $49,007.43

- Years to Debt Freedom: 60 years and 11 months

Don’t believe the math? Try it for yourself with this calculator from CNN.

Debt Avalanche Approach

Let’s look at the alternative, instead.

In this scenario, you continue to make the initial minimum payment of $340 until all debts are paid. Then, you apply the extra cash to the card with the highest interest rate, and the results change dramatically:

- Total Interest Payments: $12,365.57

- Years to Debt Freedom: 7 years and 3 months

The numbers speak for themselves.

Debt Snowball on Steroids

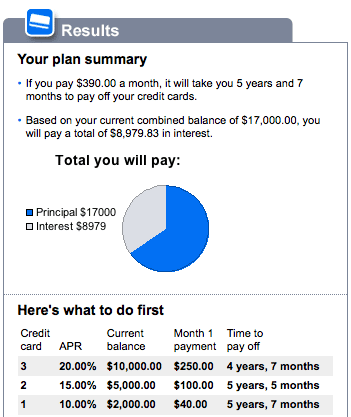

So far in our examples, we’ve calculated the current minimum payment and assumed you’ll continue to pay this amount until the debt is gone. Using the same example above, let’s now assume that you can throw an extra $50 a month at the debt. So instead of paying $340, you’ll pay $390 until you’ve killed your debt entirely.

How will this affect total interest paid and time to debt freedom? Here are the numbers:

- Total Interest Payments: $8,979.83

- Years to Debt Freedom: 5 years and 7 months

In other words, an extra $50 a month will shave nearly two years off your time to debt freedom and more than $3,000 in interest payments. Here’s a screenshot from the calculator I used to get these results:

Which Debt Should You Pay First?

You may have noticed in the above examples we’ve been applying extra cash to the credit card with the highest interest rate. Not everybody, however, recommends this approach.

Dave Ramsey is well-known for his advice to pay the loan with the lowest balance first. He recommends this approach even if you have other loans with much higher interest rates.

The rationale? By picking the debt with the lowest balance, you’ll get it paid off faster and provide yourself with additional motivation to continue. The road to becoming debt-free can be long and, well, quite boring. But paying off small loans quicker may encourage you to keep on keepin’ on.

I don’t want to get into whether Dave Ramsey is right or wrong. But it is important to realize that following Dave’s approach may cost you thousands of dollars in extra interest payments and take you longer to get out of debt.

Using our example from above, let’s assume that you continue to pay $340 a month until you’ve extinguished your debt. In this example, however, any extra cash goes to the card with the lowest balance. With Dave’s approach, here are the results:

- Total Interest Payments: $13,934.00

- Years to Debt Freedom: 7 years and 7 months

Now the difference may not seem like much. Compared to paying the cards with the highest interest rate first, Dave’s approach takes just 3 months longer. But his approach costs about $1,500 more in interest payments.

However, if this plan helps you stick to paying off debt, it can be the best one.

In some cases, the best approach is a combination. Maybe you start by paying off a couple of low-hanging-fruit debts with very low balance, regardless of their interest rates. Then you transfer some of your credit card balances to 0% APR cards. You pay those minimums while you pay off debts carrying a much higher interest rate.

Debt Snowball Gotchas

As easy as this debt repayment method is, there are several ways to go wrong:

- Watch out for more debt. The most important part of getting out of debt is to stop going into more debt. We’ve talked about this previously but it truly can’t be stated enough. While sometimes debt is outside of your immediate control, oftentimes debt is the result of bad choices. Do everything in your power to avoid new debt.

- An emergency fund is a must. Having some money set aside for unexpected bills will help you avoid more debt.

- Work on your credit. With an improved credit score, you can often get interest rates on your debt lowered. In the case of a credit card, it can often be as simple as a phone call to your issuer. With auto loans and home equity lines, it will likely require a refinance; however, the savings can be substantial and often worth the effort.

In the next article in our crushing credit card debt series, we’ll look at Ways to Free Up Extra Cash that you can then put toward your debt.