Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

It seems like the world is divided into two types of people — those that use Mac and those that favor Windows. Luckily, your personal finance software doesn’t have to pick a side.

We did the legwork and came up with the seven best personal finance software for Mac, from free to paid versions, to those that track strictly your spending to others that keep tabs on your investments, too.

Our Favorite Personal Finance Software for Mac

1. Empower

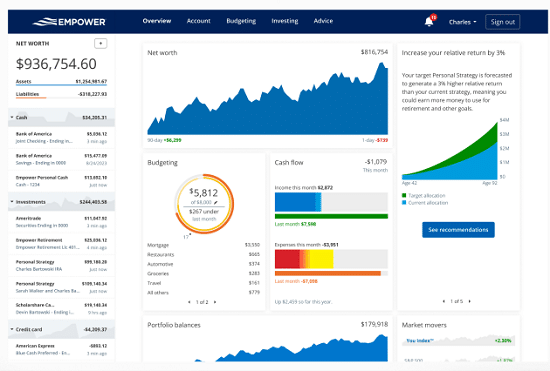

Formerly Personal Capital, Empower took top honors due to its long list of financial services, from a single dashboard to handle all your accounts to a personalized savings planner to a detailed retirement planner. Empower Personal Cash is another notable feature. You’ll earn 4.7% APY for all accounts with no minimum daily balance.

We love this personal finance tool for not only its budgeting capability, but also the aggregated dashboard, and the retirement planner, which anticipates big expenses, creates a spending plan just for you, and takes into account income events that might affect your retirement savings strategy down the road. This emphasis on retirement is further complemented by the tool’s Retirement Readiness Score, which is your total account balance translated into an estimated retirement income.

We also love the recession simulator, which shows how your nest egg will react in the case of a recession.

This platform also offers a full wealth management service, which will handle complete investment management of various investment accounts, though it’s worth noting that this is a premium feature and isn’t free.

- Monthly Subscription Cost – FREE (Wealth management services charge a fee of 0.89% for accounts valued under $1 million)

The Rest of the Best Personal Finance Software for Mac

| Software for Mac | Best User Feature |

| Empower | All-Around Software |

| Quicken | Investment Management |

| YNAB | Budgeting |

| Copilot | Smartphone App |

| TurboTax | Tax Prep |

| Mint | Free to Use |

| Banktivity | Real Estate Tracking |

2. Quicken

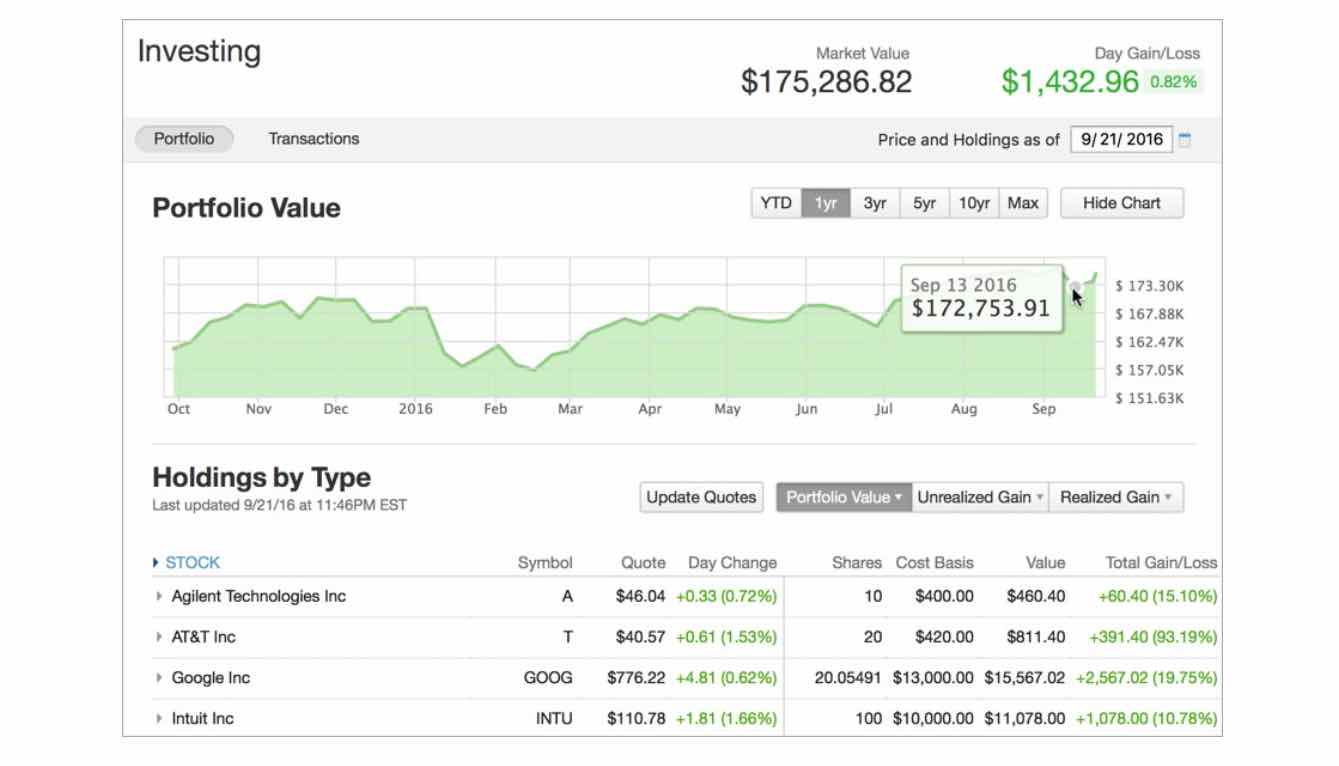

Much like Empower, Quicken Premier offers both budgeting and investment features organized into one streamlined dashboard.

You’ll connect all your financial accounts, things like your bank account, credit cards, investments, and property. From there, you can track your monthly bills, manage and grow your savings, and even create a customized 12-month budget to help you stay on track.

Quicken also helps you with your investments. Track and grow your portfolio using the platform’s investment tools, and plan ahead using the projection tools and built-in calculators.

In addition to helping you to maximize your investment worth, Quicken also helps tackle your taxes. Maximize and simplify returns with the platform’s built-in tax reports.

- Monthly Subscription Cost – $4.99

3. YNAB

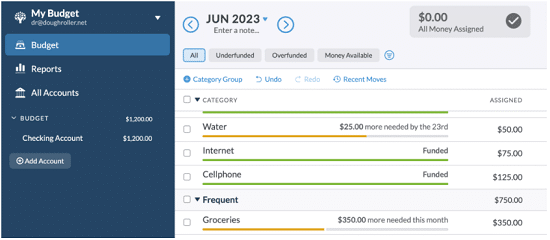

A fan favorite for a reason, YNAB provides you with a simple four rules for managing your money. First, give every dollar a job. As the name implies, you decide where you want your money until your next paycheck, down to the last dollar.

Second, the tool encourages users to embrace their true expenses. After all, who among us hasn’t set a budget that doesn’t account for unexpected expenses, effectively setting themselves up for failure? The key, YNAB says, is setting a budget that includes those non-monthly expenses, like car repairs or camp fees. That way, once they inevitably pop up, they won’t break your budget.

Third rule? Roll with the punches. A budget that isn’t flexible is one that will be broken. If your current budget breakdown isn’t working for you, change it, sans-guilt.

The final rule is perhaps the most unique. Age your money. Put simply, this means you use last month’s pay for this month’s bills, effectively putting your money one month ahead of your expenses. Wouldn’t that be nice?

- Monthly Subscription Cost – $14.99 (After a 34-day free trial)

4. Copilot

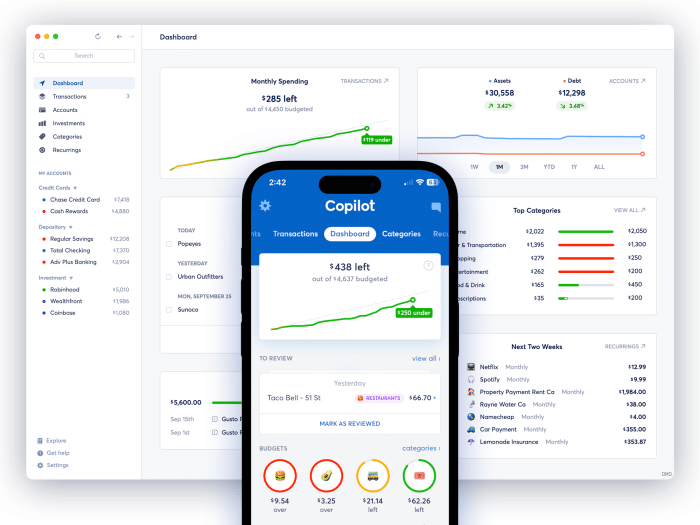

Best for those who prefer to budget via their smartphone, Copilot is a Mac-compatible tool that focuses on tracking your spending, your budget, and your investments. In fact, it’s fully native for Mac and optimized for larger screens.

We love its daily snapshots, which not only give you a real-time view of your spending that day but also alert you to bills coming up. Add in the tool’s smart categorization and budget category rollovers, and this is truly one smart budgeting app.

Looking for a bird’s eye view? With Copilot, you can also track your investments, and your home’s value, and keep tabs on your net worth.

- Monthly Subscription Cost – $7.92

5. TurboTax

TurboTax is a bit different from the other software on this list, in that it doesn’t get involved in budgeting or investing. But it does focus on one critical aspect of personal finance — your taxes.

Available for both Windows and Mac, TurboTax costs a fraction of what you would pay a professional tax preparer, but it also gives you access to a tax expert if you reach a point in the preparation process where you’re having difficulty.

TurboTax even gives you the option to purchase its Audit Defense Package to help you in case you’re audited. But should you decide, even halfway through the preparation process, that you can’t complete your return, you can turn it over to a tax expert, who will take over.

TurboTax is the closest thing to having a CPA prepare your tax return, without the price tag.

- Subscription Cost – $40 – $180 one-time annual cost

6. Mint

Mint is a great way for Mac users to manage their finances since it offers users a bird’s eye view of all their accounts, from cash to credit cards to investments to property.

This tool also allows you to track your cash flow, making it easier to see where your spending is on track — and where there’s room to incorporate saving. An interesting tool Mint offers is bill negotiation, which allows you to lower your monthly bills, adding to the $2 million already saved by other Mint users.

You’ll also get access to Mint’s other standard account features, like the bill payment tracker, free credit score, budget alerts, and even an investment tracker.

- Monthly Subscription Cost – FREE

7. Banktivity

Formerly iBank, Banktivity is an intuitive financial tool for Mac users that features an easy setup process. But don’t let that fool you. It offers a comprehensive view of features. Use the Banktivity’s organizational and productivity tools to rack, categorize, and tag every spend, or view unique reports by dates, accounts, categories, or more.

This tool also lets you focus on your financial future and your goals, like planning for retirement, saving for an education, or paying off debt. Or track the value of your real estate holdings, another feature.

We also love that you can share your Banktivity across all your devices, making it that much easier to stay organized and on top of your finances.

- Monthly Subscription Cost – $4.17 (After a 30-day free trial)

How Did We Determine the Best Personal Finance Software for Mac?

We know it can be difficult to choose a personal finance app, due mostly to the sheer number of them on the market today.

When compiling our list, we chose platforms that were available specifically for Mac users, and that were strong in one or more particular areas, like investing or budgeting. We also took into account the price and personal experience our team had in using these apps. Those with unique or particularly innovative features also earned a place on our roundup.

- Personal finance software available specifically for Mac owners

- Software that’s strong in a particular specialization

- Offers different services that would be of interest to most users

- Software costs

- Reviews from other sites (a consistent pattern of less-than-favorable reviews eliminated certain software)

- Personal experience in using some of the software

Our list of the best personal finance software for Mac was created with these guidelines in mind.

Factors to Consider

One of the complications in finding the best personal finance software for Mac or Windows is that exactly which will serve you best will depend on your individual needs. In that regard, you should consider the following factors in making your decision:

- Decide which personal finance category you need the most help with: If it’s budgeting, YNAB may be the most appropriate, since that’s what they specialize in. But if you need the most help with investing, you may want to look carefully at Quicken Premier or Empower.

- Determine how much personal assistance you may need: If you need help from a coach or a financial advisor in managing your budget, Mvelopes can provide it and might be a natural choice.

- Cost: This is always a factor, but maybe even more important if you’re on a very tight budget. You can consider using free budgeting software, such as Empower. As your financial situation improves, you may want to move up to a premium service.

- If you already have significant investment assets: Budgeting may not be your primary concern, but investing might be. Quicken Premier and Empower would be the better choice if you were in this category.

- You may need more than one software: That will certainly be true if you do your own taxes, and need to use TurboTax. But you may also want to use YNAB for budgeting, or Quicken Premier for investing.

Final Thoughts on the Best Personal Finance Software for Mac

Part of what complicates the search for the best personal finance software is that there are now so many options. You could spend weeks or even months searching through dozens of potential choices.

It may help to first decide exactly what you expect the software to do for you, so you can narrow the search. For example, if saving money is a priority, you’ll want to narrow your search down to budgeting software that also helps you to set savings goals. If paying off debt is a priority, you’ll want to look for software that specifically helps you with debt reduction strategies.

It’s also likely that over time your personal finance needs may change, and so will the tools you need to manage your money. For example, once you’re out of debt and you have some savings, you’ll probably want to move to software that provides investment services.

Choosing a personal finance tool isn’t a one-size-fits-all approach. Your needs are unique and will likely change in the future. What’s important is that whatever tool you choose helps you take an active role in managing your finances. And that’s one thing that doesn’t change.