Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Rules of thumb are loose “rules” that apply broadly to many situations. We talk about rules of thumb a lot here on Dough Roller.

Regarding personal finance, the key word is “personal.” There are no one-size-fits-all rules for running your budget, savings, retirement planning, or other aspects of your financial life.

That said, some general, tried-and-tested rules can be useful for planning your financial life. While you might decide to tweak these rules in the application, they can help guide your financial decision-making.

So, without further ado, here are 35 money rules of thumb that will help you rock your budget (and retirement savings, future financial planning, and more!).

Basic Money Rules of Thumb

1. Pay yourself first. This old rule of thumb helps you save rather than spend all your money. Even if your budget is tight, put some money into savings as soon as you get paid. Saving first, rather than last, means you’re much more likely to save money instead of spending it.

2. Add your raise to your savings account. Don’t move significantly above that once you’ve achieved a salary that funds a lifestyle you’re content with. When you get a raise, put it into savings rather than spending it. This can help avoid lifestyle inflation while significantly growing your savings.

Best Savings Account Deals

- Barclays Online Savings – A Barclays Online Savings Account offers a high-yield savings option with no monthly maintenance fees and a competitive interest rate currently at 4.35%. This account allows for easy online management and requires no minimum balance.

- Discover® Online Savings Account Member FDIC – A Discover Online Savings Account provides an attractive interest rate with no monthly fees or minimum balance requirements. It features easy online and mobile access for convenient account management and includes tools like automatic savings plans to help users grow their funds effectively. The current APY is 4.25%.

Related: Here’s a list of high-yield savings accounts.

3. When an appliance breaks, buy a new one if the appliance is 8+ years old, or the repair would cost more than half the replacement cost. This goes for things like fridges, TVs, dishwashers, etc. Get an estimate on the repair cost. If that cost is 50% or more of the replacement cost, you’re usually wiser to replace the broken appliance. And for older appliances, you might consider doing the same even if the repair costs are lower. Older appliances are more likely to have subsequent issues with other parts.

4. Use 12% of an unexpected windfall for a treat, but bank the rest. Use a small percentage to treat yourself immediately, whether a gift, an inheritance, or an unexpected bonus. Put the rest in the bank, and give yourself a few months to think about the wisest way to spend that unexpected money.

Budgeting

5. Try the 50/30/20 rule for budgeting. If you’re new to budgeting, try allocating 50% of your take-home pay towards necessities (food, shelter, utilities, clothing, etc.), 30% towards lifestyle choices (vacations, gym fees, hobbies, cell phone plans, etc.), and 20% towards financial goals and priorities (extra debt payments, savings, etc.). The 50-30-20 budget isn’t perfect, but it can be a good place to begin.

6. Track at least your problem spending areas. Some people like a very detailed budget. Others, not so much. If you don’t want to track every line item, track at least those areas where you tend to overspend, whether dining out, buying new clothes, or spending on kids’ items. This can help you control your spending without being bogged down by an over-detailed budget.

7. Spend about 10-15% of your budget on food. This includes groceries and dining out. Find places to cut back if you struggle to keep your budget within this range.

8. Allot 2-10% of your budget for personal items. This includes items like entertainment, getting your hair cut, and buying clothing, which would take up no more than about 8% of your monthly budget. This is a flexible area, though, and you can always cut back if you need to save more money.

9. Use a cashback credit card for purchases and pay the balance in full each month. There are credit cards that pay cashback as high as 5%. Using a cashback card to make routine purchases and pay off the balance in full each month to avoid interest charges will be like getting a discount on everything you buy. Check out the best cashback credit cards and choose the right one.

Savings and Investing

10. Save three to six months’ expenses in an emergency fund. There are many different rules of thumb for this one, but this one makes the most sense for most people. Remember, these are expenses, not income. And if you’re in a volatile field of work or the economy is in a downturn, consider saving eight or even 12 months’ worth of expenses.

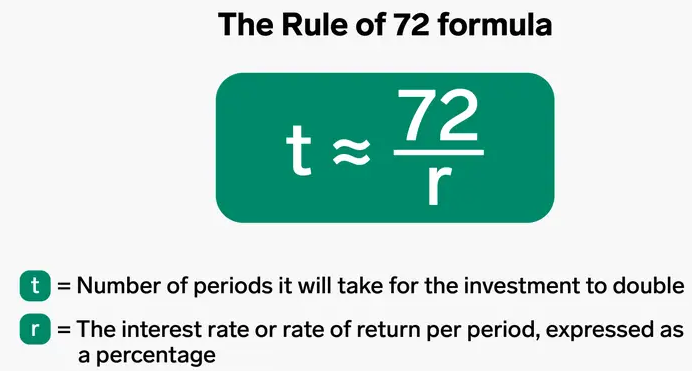

11. Use the rule of 72 to determine how long it will take for your investment to double. To use this rule, divide 72 by the expected growth rate of your investments, expressed as a percentage. For instance, if you expect to earn 10% annually, doubling your money takes about 7.2 years.

12. Aim to have your portfolio double about every ten years. How do you know if your investments are on track and growing well? One rule of thumb is that your well-managed portfolio should double every ten years. Your mileage may vary, but if you’re not even close to doubling after a decade, consider rebalancing your investments.

13. Earn $100s with a Sign-Up Bonus Credit Card. Did you know there are hundreds of credit card offers paying signup bonuses worth hundreds of dollars? If you normally spend at least some time on credit cards, plan to periodically apply for a new card with a generous signup bonus. It could help you add several hundred dollars to your savings each year.

Debt

14. Put no more than 30-35% of your net income towards minimum debt payments. This is the rule if you have a mortgage. If you don’t have a mortgage, you should put no more than 30-35% of your net income towards minimum debt payments and monthly rent. This is a somewhat high figure, and it’s always better to have even less of your income devoted to debt. However, the 30-35% range is what mortgage lenders, in particular, will look at when considering the debt-to-income ratio.

15. Pay off your highest-interest debt first. There is much disagreement about debt repayment methods, but this is the one that will save you the most and get your debt paid off most quickly. You might want to deviate if you’re trying to boost your credit score quickly. In this case, first, pay off any credit cards that are currently maxed out. Then, pay off debt from the highest to the lowest interest rate.

16. Debt Payoff Strategy Plan B: Payoff your smallest debt first. Dave Ramsey, also known as the Debt Snowball, made this strategy popular. It’s a simple concept based on paying off the smallest debt first since it’s the most doable. Once that debt is paid, you allocate the monthly payment you would have made on the smallest debt to the next smallest debt, which should at least double the payment on that next debt. That should enable you to pay off the second smallest debt in a short time frame.

As you work your way up the debt ladder, taking out the next smallest debt gets easier due to the extra cash flow from the smaller debts already paid until you’re ready to tackle your biggest debt. By then, it may not seem intimidating because you’ll have the extra cash flow and the successful track record from paying off your smaller debts. It’s a solid strategy if paying off your highest-interest debt first is too tall a task.

Retirement

17. Save 10-20% of your income for retirement. The old rule of thumb was to save 10% of your gross income for retirement. That seems to be a little low, especially for younger workers who may not have a pension to fill in the gaps. Aim a little higher than that, especially later in your career, if you want to be ready for retirement.

18. Subtract your age from 100; the resulting number is the percentage of your portfolio you should invest in stocks. If you’re 50, for instance, you should invest about 50% of your overall portfolio in stocks. This is another rule of thumb that can vary greatly. You could bump this rate up if you’re more risk-tolerant or planning to work and invest longer. Consider a more conservative style if you’re less risk-tolerant or want to retire early.

19. Always take the employer match on your retirement account. If your employer offers any match for retirement investments, save at least enough to get that match.

20. Calculate your current pre-retirement expenses plus 10% to plan your annual retirement needs. Many rules of thumb say to aim to live on a certain percentage of your current income in retirement. But this may not make sense if you save a significant portion of your income and still live well. Instead, use your expenses to calculate your annual retirement needs.

21. Aim to save 1X your annual salary by 35, 2X by 40, 3X by 45, and so on. This is a rule to help you see if you’re saving enough for retirement. If you’re far off these numbers at various ages, consider cutting your spending to boost savings.

College

22. Save for retirement first and your kids’ college expenses second. This is counterintuitive for parents who spend their lives putting their kids first. But remember: your child can borrow, if need be, for college. You cannot do the same for retirement.

23. Limit your student loan borrowing to your first year’s expected annual salary. Research typical first-year salaries in your field to keep your student loan borrowing in check. Keep your student loans’ total balance to this amount or, preferably, much less.

Mortgages

24. Put at least 20% down when you buy a home. This is a good idea for two reasons. First, it limits the total amount you borrow on your home, leading to significant savings over time. Second, it means you don’t have the added expense of private mortgage insurance (PMI). Third, you are much less likely to go underwater on your home if the market has another major downturn.

25. Buy a home that costs no more than 2.5 to 3 times your gross annual income. Again, this is a good way to limit your spending on your home, keeping things within an affordable range. However, it doesn’t consider interest rates, taxes, and insurance. If interest rates are high or your property taxes will be enormous, consider limiting yourself to just 2X your annual income.

26. Consider refinancing your home if interest rates drop by 1% or more. The important piece of this rule of thumb is “consider.” Refinancing is always a case-by-case issue, depending on how long you plan to own the home, your current rate, and how much the refinance will cost. But if rates drop by 1% or more, you should at least take time to do the math on a refinance.

27. Fix your mortgage rate for as long as you plan to live in your home. Fixed-rate mortgages are the norm for many reasons. But if you’re considering a variable-rate mortgage, ensure the rate will be fixed for at least as long as you plan to live in the home. Variable rates can make sense if you plan to move on in a few years. But even then, they can be dangerous, so just be careful.

28. Don’t prepay a low-rate, deductible mortgage. Deciding whether or not to prepay on your mortgage can be tough. But, generally, if you’re already getting a good rate, you should use that money for other important financial goals. This is especially true if you’re talking about your primary residence, where the mortgage interest will be deductible on your federal income taxes.

29. Your mortgage should be the last debt you pay off. Many homeowners prioritize paying off their mortgages on the path to debt freedom, but that makes little sense if you have other debts. Car loans, student loans, and especially credit cards typically carry higher interest rates than mortgages, so paying them off should be a priority. In addition, paying off non-mortgage debt first will provide the needed budget boost to take on paying off your mortgage eventually.

Speed is another consideration. While you may take the next 15 years to pay off your mortgage early, you could have your car paid off in two or three years, providing a much more immediate cash flow benefit.

Cars

30. Plan to buy used or new and drive the car for at least ten years. Generally, buying new isn’t the better financial option. But if you can drive the car for ten years or more, buying a new one can sometimes be a decent financial investment.

31. Use the 20/4/10 rule if you must finance a vehicle. Your best bet is to pay cash for any vehicle. But if you must borrow, put at least 20% down. Don’t finance the car for more than four years, and don’t put more than 10% of your income towards payments. This may limit your means to buy a nice vehicle, but it’ll keep you from making stupid decisions at the car lot.

32. To estimate the actual cost of owning a car over five years, double the price tag and divide that by 60. So, buying a $10,000 car costs about $333 per month for all its expenses, including plating and insurance.

33. Don’t spend more than 20% of your take-home pay on all costs for all the vehicles you own. This includes costs like insurance, plates, and maintenance, too. Again, this can seem limiting if you’re setting your sights on an expensive vehicle. However, limiting your total vehicle costs to 20% or less of your take-home pay will keep you from spending too much on a depreciating asset.

Insurance

34. Have 56 times your gross annual salary in life insurance coverage. If you need life insurance, the term is usually (though not always) the best bet. When deciding how much term coverage to get, multiply your annual salary by five or six, and opt for at least that much total coverage. Consider getting even more if you have special life insurance needs, like multiple children or high debt. If you don’t bring in an income but provide essential services to your family

35. Use insurance for catastrophic expenses, not basic ones. As with high-deductible healthcare plans, this is how the insurance world generally works. Whether it’s car or homeowners insurance, you shouldn’t rely on your insurance to pay for expenses you can handle out of pocket. This will only increase your deductible and your overall costs over time. Instead, consider insurance a last-ditch backup rather than a financing plan for general life costs.