Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Quicken is a popular personal finance software, but it’s designed strictly for Windows users. If you use Mac, Quicken is not an option. But that’s where Banktivity comes into the picture. Banktivity is a personal finance software app designed specifically for Mac devices.

The company claims customers save $500 a year and 40 hours of time using the Banktivity app.

About Banktivity

Banktivity is offered by IGG Software. They describe themselves as a small company based in Putney, Vermont. They focus on writing applications for Mac and Apple mobile devices. Their apps are designed to help people manage their paychecks, bills, and their financial futures.

The company was founded by Ian G. Gillespie, which is where the “IGG” in the company name comes from. The company is comprised of professionals who work remotely, with the idea that eliminating commuting cuts their carbon output.

One of the features that differentiate Banktivity from the competition is that they interact with their customers. For example, if you have an idea for an improvement or a new feature, you can submit your request and they will consider implementing it. They encourage feedback from their users in an attempt to continuously improve the product.

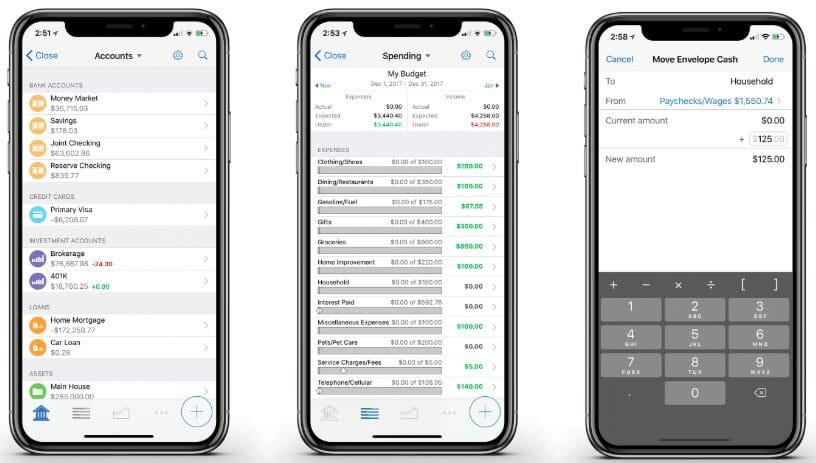

The current iteration of Banktivity–Banktivity 7–is the seventh in the line, and was rolled out in September 2018. Banktivity is available for Mac, iPad, and iPhone devices.

How Banktivity Works

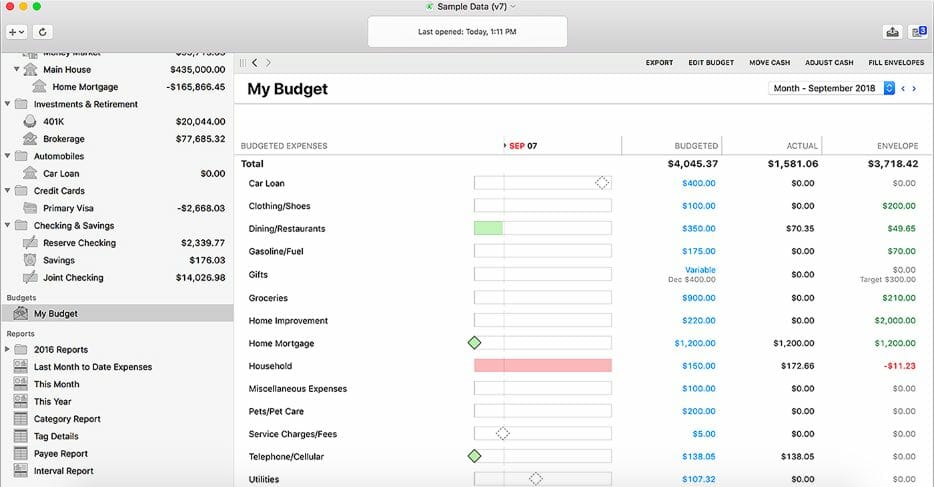

Banktivity works by connecting all your financial accounts in one place, so you can make smarter decisions. You sync your accounts on the app, and the information is held on the Banktivity private and secure cloud.

The app can be set up in a matter of minutes. You can connect to more than 14,000 different banks, and the app even allows you to track the value of your home and any other real estate you own.

Once you’ve set up the app, and synced your financial accounts, you can set up digital envelope budgeting. That will give you complete control over your finances, by enabling you to make a plan for spending each dollar out of your paycheck. And you can make payments using either cash, checks, debit cards, or credit cards.

It even prioritizes your budget, putting your most important envelopes first. From there, you start filling your less important envelopes. And when an envelope is empty, it means no more spending can happen in that category.

The app even allows you to adjust for overspending in a category. When you do, you move money from another envelope to cover the higher expense in the other category. This keeps you from having to borrow money or tap savings to cover the excess expense.

Setting Goals

This is the key to improving your financial situation. While you’re using your digital envelope system to pay your expenses, you can also set up financial goals. They can be set up to pay off debt, buy a new car, save for the down payment on a house, or for any other purpose you choose.

Goals can be used to create an emergency fund, as well as to build up retirement savings. Meanwhile, if you are a homeowner, you can track the value of your property on a regular basis. In this way, Banktivity enables you to stay on top of your investments, as well as your budgeting.

Banktivity comes in 3 different versions:

- Banktivity 7: Designed for macOS High Sierra and Mojave, it’s their most powerful finance app ever.

- Banktivity 6: The older version, designed for macOS Sierra and High Sierra.

- Banktivity Personalized Plan: This version provides one-on-one help in personalizing the app for your finances. You can schedule a one-hour, audio-enabled, screen-sharing session with a Banktivity expert.

Signing up for Banktivity

You can sign up on the website. Once you make your purchase, you will receive an email that will include your registration code. You can then download the Banktivity app from the website. Your registration code will unlock the trial restrictions.

Banktivity Features and Benefits

Savings Rate: Banktivity automatically calculates your savings rate, letting you know how successful you are in that all-important category.

Net worth: Banktivity provides an automatic breakdown of your net worth on a continuous basis. A steadily increasing net worth is an indication of progress toward your financial goals.

Non-U.S. customers: Banktivity is available internationally. In fact, they have thousands of users in over 50 countries.

Customer support: There’s no phone contact, but you can reach a staff member either by live chat or by opening a support ticket. You can also check the website FAQ page or search support articles for answers to your questions.

Banktivity security: The Banktivity cloud sync is built with device-based end-to-end encryption, so that your data will never be transmitted without first being encrypted. The company also promises they won’t sell your data to advertisers or try to sell you financial products, like credit cards or insurance.

Free resources: The Banktivity website offers a blog (Personal Finance 101) to help you to become more money savvy. For example, they provide articles on budgeting, cryptocurrencies, buying a car, breaking the paycheck-to-paycheck cycle, and retirement planning.

They also offer free weekly courses, where you can participate in webinars with a Banktivity expert.

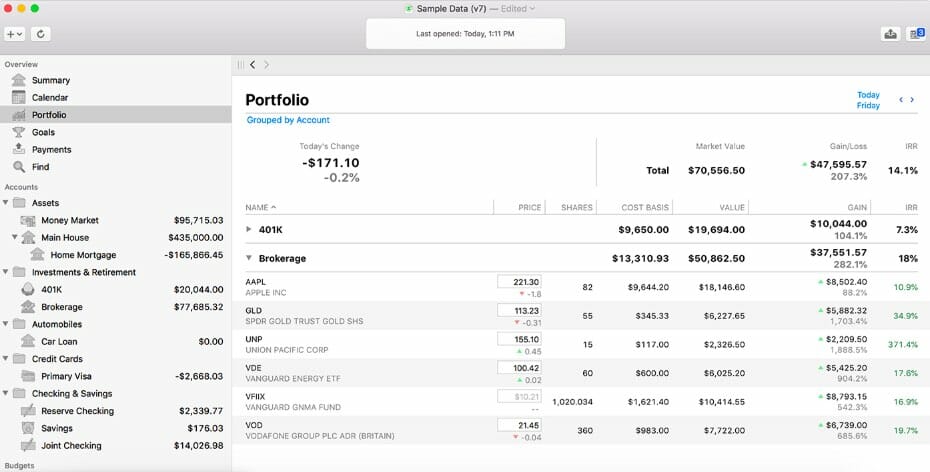

Banktivity Investment Tracking

Banktivity offers some sophisticated investment tracking capabilities. For example, it calculates percentage gain, return on investment, as well as internal rate of return (IRR), on your investments.

You can also choose how you want to track stock lots, using either first-in, first-out, or custom. It can show you long-term and short-term capital gains, dividend returns, and provide an integrated portfolio to show you exactly where your investments stand.

The Banktivity investor feature automatically updates quotes from Yahoo! Finance on your investment positions. It also provides key stock data, including 52-week high/low averages, and dividend yields. It also streams the latest financial headlines, complete with ticker symbols, so you can stay on top of any news that might affect your investment positions.

The Banktivity investor feature automatically updates quotes from Yahoo! Finance on your investment positions. It also provides key stock data, including 52-week high/low averages, and dividend yields. It also streams the latest financial headlines, complete with ticker symbols, so you can stay on top of any news that might affect your investment positions.

And at any time, you can get more information on your investments. All you need to do is tap on any ticker symbol, and you’ll be able to view performance statistics for that investment position.

Special Features for iPhone

Direct Access: This is an optional feature for iPhone devices. It’s Banktivity’s exclusive connectivity option, that automatically updates your account data from over 10,000 financial institutions around the world. The cost of the service is $44.99 for one year, $13.99 for 90 days, or $5.99 per month.

Tags: You can tag your transactions on your iPhone, then sync them back to Banktivity for Mac or Banktivity for iPad.

Custom interval budgeting: Banktivity for iPhone can give you the flexibility to budget varying amounts in different months. For example, if you know you’ll be spending more money around the holidays, you’ll be able to budget around the higher expenses.

What’s more, Banktivity for iPhone is now free.

Banktivity Pricing

You can Sign up for the app, and use it for free for 30 days. You don’t even need to put a credit card on file. When the 30-day trial is over, you will be notified, giving you an opportunity to purchase the app.

Pricing for the three versions is as follows:

- Banktivity 7 – $69.99

- Banktivity 6 – $64.99

- Banktivity Personalized Plan – $59.00

If you already have Banktivity 5 or 6, you can download Banktivity 7, and purchase it for a discounted price within the app.

PayPal payments are accepted, but only when payments by credit cards are rejected by the online store.

Banktivity offers a 90-day money-back guarantee on all software purchased through their online store. If you’re not satisfied for any reason, you can contact customer support, and the purchase will be refunded in full. (NOTE: Refunds on purchases made from iTunes App Store, Mac App Store, and retail stores, like the Apple Store, Office Depot, or Amazon.com, will be determined by the refund policies of those vendors.)

Banktivity Pros and Cons

-

Great for Mac users: Banktivity is an excellent budgeting and investment tracking app, designed specifically for Mac users.

-

Available internationally: The app is available to non-U.S. customers.

-

Money back guarantee: Banktivity offers a 90-day money back guarantee if you’re not satisfied, but only if the app is purchased through their online store. That will give you plenty of time to decide if the app will work for you.

-

Easily connects to banks: The app can sync with more than 14,000 financial institutions.

-

30-day free trial: You’ll be notified toward the end of the trial period and given a choice to continue. They don’t even require you to put a credit card on file. This is very different from the “free trial offers” that take your credit card information, then automatically enroll you unless you specifically notify them of your intention to not continue with the service.

-

Only for Mac users: Banktivity is designed strictly for macOS, iOS and watchOS. It is not available for Windows, Blackberry, Android or other devices and systems.

-

No phone support available: This is typical of personal finance apps.

-

Costly: At $69.99 for Banktivity 7, the app is pricey given that Mint and Empower offer similar services free of charge.

Banktivity Alternatives

Mint is a free online personal budgeting platform with limited investment features. You can track your investments via Mint but you won’t be able to actively manage them nor get any investment-related help.

Empower offers a free financial dashboard where you can see your net worth and get a big picture view of your finances but budgeting capabilities are limited here. They do provide significant investment features and advice under their Wealth Management service but the initial investment you’ll need is $100,000 or $200,000 if you want regular access to financial advisors. The key here is Empower provides an element that’s difficult to find in the world of robo advisors and that’s active human investment management working alongside automated investment tools. You can read our full review of Empower here.

(Personal Capital is now Empower)

Related: Empower vs. Mint — Which is Better for Managing Your Money?

FAQs

[faqs-content id=”7PQKOW24TVAA3L7UOKUONF3D44″ /]

Bottom Line – Should You Sign Up With Banktivity?

If you’re a Mac user, and you’ve been waiting for a budgeting and investment app similar to those commonly available to Windows users, Banktivity could be the app you have been waiting for. It will allow you to track all your financial accounts on a single app, set up a budget, and create and work toward goals to improve your financial situation.

The ultimate goal of any financial software should be to help you move toward a better place, financially speaking. Banktivity will both enable you to get control of your finances and implement multiple savings goals that will guide you to get where you want to go.

To get more information, or to sign up for the service, check out the Banktivity website.

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC