Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

By thinking through your individual needs and wants, as well as saving up and positioning your finances, you can successfully get through buying your first home and make the most of your money.

Getting ready to buy your first home is a big deal. It involves a lot of preparation, saving, and legwork. So before you start shopping around on Zillow, read through our complete guide on how to buy your first home. We’ll give you lots of solid advice, and then link you to other articles where you can get a more in-depth explanation of certain concepts.

1. Run a Personal Cost-Benefit Analysis

Before you buy your first home, you should decide whether that’s what you really want. All too often, buyers assume that purchasing a home is the right choice. After all, that’s how you build equity and wealth, right? And you’ll stop “throwing money away” in rent every month?

Well, maybe.

The fact is that homeownership isn’t for everyone. And you’ll need to look at your personal situation–financial and otherwise–objectively to figure out if it’s the right move for you.

For instance, what if you’re building a budding career that’s likely to take you to a new location within the next couple of years? Once you buy a home, you may need to own it for several years before you’ll break even when you sell. That’s because there are plenty of costs involved with both buying and selling. So if you’re highly mobile, right now may not be the best time to buy a home.

On the other hand, if you think you’ll be in the same location for a while and are ready to settle in, homeownership may be for you. But even in this case, it’s not always true that buying a home is best. Here’s what you need to consider first.

Don’t Assume You’ll Save Money

If rents are high in your area, it’s easy to assume that a modest mortgage would be cheaper than your monthly rent. And, in fact, your mortgage payment might be cheaper than your rent payment. But that doesn’t mean homeownership is necessarily less expensive than renting.

Resource – Should you rent or should you buy

When you rent, someone else is absorbing many of the costs of maintaining and improving the property you live in. That’s why rent is expensive!

When you own the home, you’re on the hook for the broken water heater, the leaking roof, or the everyday maintenance of windows driveways, and gutters. With all these additional costs, owning a home could wind up being more expensive than renting. Check out this article for a list of 30 things you’ll need to budget for when you own a home.

On the flip side, owning a home lets you build equity in a valuable piece of property. Sure, that $200 you pay to fix the plumbing may not help you build wealth directly. But your $1,800 a month mortgage payment will go partially towards building equity in your home. And that can be powerful.

The bottom line here is that you can’t make assumptions either way. You need to look at what you pay as a renter, what you’re likely to pay as a homeowner, and which option works best for you financially.

Related: How House Hacking Works

And Remember Time, Too

For more and more people, renting is becoming something of a lifestyle choice. When you own a home, you’re tied down with weekend chores. Trust me, it takes a lot of time to do even the basics like maintaining the lawn and minor home repairs. When you add in things like keeping the roof in good condition and cleaning the gutters, you can kiss at least half your weekend’s goodbye.

Again, this isn’t a cut-and-dried argument. For some people (like me) the wealth-building or emotional aspect of owning a home is enough to counterbalance the time it requires. But if you can’t picture yourself settling into domesticity to maintain your new home, maybe you should stick with renting for a while longer.

So before you even start shopping around or looking at mortgage rates, run your own personal cost-benefit analysis.

Related: Does Paying Rent Improve Your Credit Score?

2. Get Your Credit Score in Shape

If you decide buying a home is the right option for you, it’s time to do the preliminary work of getting your credit score in shape. (Honestly, you should do this even if you plan to be a renter forever. Eventually, you’ll probably need some credit, so having a good credit score is a good idea!)

This starts with actually knowing what your credit score is. You can go about this in a couple of different ways.

Experian Boost is the perfect place to start. They’ll look at things like your rent payments, utility payments, and cell phone bills and if all of your accounts are in good standing, you’ll stand to receive a boost to your credit score. The service is free and the awesome thing is that negative information (like missed payments on your cell phone) is not counted.

You can also get your credit score from many credit card companies. Some, like Discover, offer the option even to those who aren’t customers.

However, as you get closer to applying for a mortgage, it may be a good idea to spring for a copy of your “real” credit score–the one lenders see. In fact, I would go so far as to purchase a copy of your score from each of the three bureaus.

How to Boost Your Score

We’ve got a ton of in-depth content on how to boost your credit score, so we’re just going to give you a bare-bones outline here. Click on the links to learn even more.

Here are the basic steps to take to increase your credit score:

- Correct mistakes and errors. Many consumers notice errors in their credit reports. This could be as simple as an incorrect mailing address. Or it could be as complex as showing an account you don’t actually own. Either way, you’ll need to correct these errors as soon as you can.

- Ask for some goodwill. Late payments on your credit report can seriously harm your score. But what if you’ve got a record of a single late payment in an otherwise squeaky-clean history? Consider asking the lender for a goodwill adjustment.

- Make payments on time, every time. Your credit score is really all about one thing–telling lenders how risky you’d be as a customer. And lenders really hate late payments. So consider automating your finances or using a budget tool like Mint.com to track when payments are due so you don’t miss any.

- Pay down your revolving debts. Lenders don’t like to see that you’re maxing out credit cards or carrying too much revolving debt. Paying down these balances can be one of the quickest ways to improve your score.

- Use credit wisely. Contrary to popular belief, you don’t actually have to carry a balance on your credit card or otherwise go into debt to build your credit score. If you’re starting from scratch, you just have to use credit wisely. This means only taking out modest installment loans (like car loans) when you need them. It means using a credit card but paying off your balance each month.

- Leave older accounts open. It may seem like a good idea to close credit cards you no longer use, but this may actually damage your credit score. Here’s how to cancel those accounts without harming your score.

- Keep on keeping on. Building your credit score takes time. It’s worth the effort, but you’ll want to start several months–at least–before you plan to apply for a mortgage. Keep using credit wisely, keep paying down debts, and make payments on time. You’ll see your score increase so you’ll save for that future mortgage.

Why It’s Worthwhile

Before we move on to the next point, let’s hammer home why raising your credit score is so important. A higher credit score means a lower interest rate on your mortgage. A few points of interest may not seem like a big deal. But when you’re talking about a huge loan with a 15- to 30-year life, it can add up quickly.

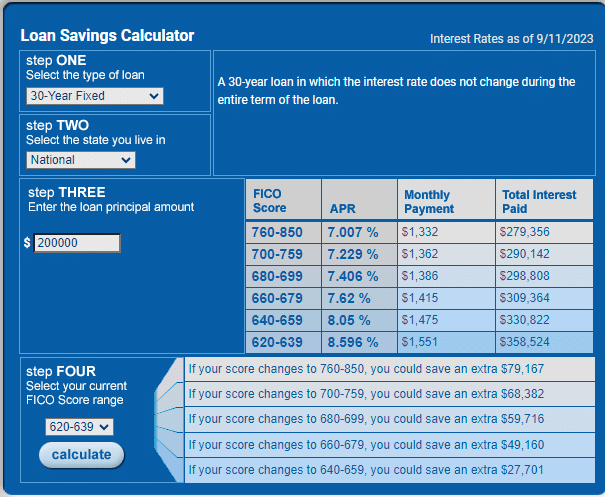

This calculator from myFICO can help you see just how much you’d save by increasing your credit score.

Using FICO’s national average on a 30-year fixed mortgage loan, let’s assume you’re going to take out a $200,000 mortgage. Right now, your credit score is in the 620-639 range. Here’s what FICO’s calculation looks like:

Raising your score to the next tier can save you tens of thousands of dollars over the life of your loan! Raising it to the middle-of-the-road 680-699 range could save you even more. These savings come in the form of less interest paid over the life of your loan, as well as smaller monthly payments.

Clearly, taking the time to work on your credit score before you apply for a mortgage is worth it!

3. Start Saving for That Down Payment

While you’re working on improving your credit score, it’s also time to start saving for your down payment. Low down payment mortgages are available. But you’ll likely need to have some down payment. And, in reality, saving the traditional 20% is a great option.

Related: Should You Save For Emergencies or a Down Payment First?

Why a Bigger Down Payment is Better

If you can access a 3.5% down payment mortgage, why would you wait to buy until you’ve saved 20%? Well, there are lots of reasons this might be a better option. Here are the top three:

- You’ll be less likely to go underwater on your mortgage. A mortgage is considered underwater when your home is worth less than what you owe on it. This is what happened to many homeowners during the mortgage crisis. It is not a place you want to be. Starting off with 20% equity in your home is a good way to avoid this situation for the most part.

- You won’t have to pay PMI. Until you have at least 20% equity in your home, you’ll have to pay private mortgage insurance. This is a lender requirement so they get their investment back if you are unable to make mortgage payments. When you start off with a very low down payment, you’ll be stuck with this monthly payment for years.

- You’ll build the discipline of saving. Saving up a big down payment, especially when you’re renting, can be difficult. But aiming for a big down payment gets you into the habit of saving a lot of money every month. This will serve you well as a homeowner when you need to save up for inevitable repairs, upgrades, and more.

But Don’t Despair if You Can’t Get There

With all that said, you don’t have to have a huge down payment to become a homeowner. If you’re in a city where rents outpace mortgage payments by a lot, this may not be possible. Maybe it would take you decades of saving to get a full 20% down payment.

In this case, or if your income is just too low to save that much money, consider a mortgage with a lower down payment option. You can find a list of potential lenders and mortgage types in this article.

Starting out with a low down payment can get you into a home. And then you can figure out ways to pay down the principal more quickly. Paying down the principal can help you get rid of PMI and can keep your mortgage from going underwater.

How to Save for a Down Payment

At its core, saving for a down payment is about budgeting and discipline. You’ll need to keep track of your spending so that you can find new ways to save. And you’ll need to save on a regular basis, especially if you want to buy a home soon.

You’ll also want to think about where to stash those down payment savings. You’ll need to keep it somewhere safe and without a lot of volatility.

And Don’t Forget Closing Costs

Too many first-time homebuyers don’t know anything about closing costs. These are additional fees and charges you pay at closing when you purchase your home. And they can be quite substantial. Plus, they’re paid on top of your down payment!

There’s a lengthy list of closing costs you can expect to pay when you purchase a home. The bottom line here is that you should expect to pay anywhere from 3 to 7 percent of your home’s purchase price in closing costs.

You can roll these costs–or at least some of them–into the mortgage, but that means you start off with less equity in your home. The best-case scenario is to pay them in cash when you close. Again, though, if you can’t save enough to pay for all the closing costs, you have some options.

For one, again, you can roll some of these costs into your mortgage. Another option is to ask the seller to pay some of the costs. Motivated sellers will often do this out of the proceeds of the sale, which can be helpful. The article linked above tells you how to figure out your closing costs and various options for paying them.

4. Understand Your Mortgage Options

Before you start shopping for a mortgage, you need to understand basic terminology and options. This will help you figure out which mortgage is the best fit for your particular needs and situation.

First, we’ll talk about some basic mortgage terms. Then, we’ll discuss a few specific types of mortgages you might consider.

Fixed-Rate vs. ARM

These terms all refer to how the interest works on a mortgage. The first option is the most common.

In a fixed-rate mortgage, you pay the same interest rate for the life of the loan. Unless you refinance to another loan or type of loan, the rate doesn’t change. Fixed-rate mortgages are great because they’re dependable. You know what your payments will be every month.

However, with a fixed-rate mortgage, you can’t take advantage of a falling interest rate environment. If interest rates drop substantially from your current fixed rate, you’ll have to go through the hassle of refinancing to take advantage.

An adjustable-rate mortgage (ARM) is one where the interest rate varies depending on some kind of index. So as the index rises or falls, so will your mortgage’s interest rate. This means that you can take advantage of a low-interest environment without any additional work on your part. But it also means that when interest rates increase, your mortgage payment might, as well.

Some ARMs are adjustable right from the start of the mortgage. Others are a hybrid option. For instance, a 7/1 ARM has a fixed interest rate for the first seven years of the loan and then adjusts annually thereafter. ARMs are quite complicated, and you can learn more about their pros and cons in this article.

There are other types of mortgage interest options, but they’re less common. For instance, you can sometimes get an interest-only mortgage where you pay only the loan’s interest for a set period of time. But, again, these mortgages are a much less common option.

15- vs. 30-Year Terms

Any mortgage that you take out will have a term. This is the length of time that it will take you to pay off your mortgage if you only make the minimum payments. While mortgage terms can vary widely, the most common options are 15 years and 30 years.

Because a 15-year mortgage is less risky for the lender, it’ll come with a lower interest rate. This means they can save you a load of money in interest over the life of the loan. But 30-year mortgages come with a lower monthly payment, giving your budget more breathing room.

Which option is best for you? It depends. Longer mortgage terms are still more common than 15-year options. But 15-year mortgages can also be a great option if you want to get out of debt more quickly and benefit from the lower interest rate.

It’s important to examine the pros and cons of this choice. Calculators like this one can help show you how your loan will amortize either way, which can be helpful. We’ve also provided insight into ways to make a 30-year mortgage as financially savvy as a 15-year mortgage.

Government-Insured vs. Conventional

Homeownership is important for consumers and the economy. However mortgage loans are huge and risky for lenders to offer. So the federal government has stepped in to insure certain types of mortgages, especially for riskier borrowers. If you have a lower credit score or a lower income, a government-insured loan may be your only option.

Government-insured loans often come with more restrictions. For instance, you may not be able to buy a super-expensive house compared to the other homes in the area where you live. But these loans are easier to get if you’ve got a bad or short credit history, or if you can’t save a 20% down payment.

Conventional loans tend to be cheaper, but they’re harder to get. These loans may come with fewer additional fees and a lower interest rate. But you’ll need to have a hefty down payment and a good credit score to qualify for most conventional loans.

Since you’ve already been working through our handy checklist, you should have an idea of what your credit score is and how much you plan to save for a down payment. This will let you know whether you should work for a lender that offers government-insured loans or opt for a conventional option.

5. Where to Find the Best Mortgage Lender

Finding the best mortgage lender is an important part of the process. Compare rates and terms so you can find the mortgage that best fits your needs. Shop around and get a few quotes. Knowing your credit score can help you get a more accurate view of your situation and options.

Quicken Loans/Rocket Mortgage

Quicken Loans is the largest online lender in the country. The process is entirely online, and Quicken Loans offers a number of mortgage options, including FHA loans. Quicken Loans, with its Rocket Mortgage product, purports to streamline the process, allowing you to get into your dream home quicker. You can contact an account executive to help out if needed. Note: Quicken Loans is changing its name to Rocket Mortgage on July 31, 2021.

Bankrate.com

Bankrate.com aggregates mortgage information, providing you with rate quotes from lenders in your area and helping you connect. Additionally, you can see a projected monthly payment based on your home price and credit score, as well as other factors. This makes it easy to compare different mortgage options and then click on the one you think will work best for you.

Local Financial Institutions

If you aren’t sure about aggregators or online loans, you can compare them with local institutions. Sometimes small community banks and credit unions can offer you better deals. Additionally, because they are in the community, they might be more willing to work with you.

Big Banks

Don’t forget to check the big banks. CitiMortgage, Bank of America, and Wells Fargo all offer home financing and a variety of products, including conventional products like the Home Ready loan from Fannie Mae. Sometimes they offer lower rates in order to draw new customers. Or, if you’re already a customer, you might be able to get a discount on your rate.

6. Make Your “Must Have” List

Now we are finally to the section every homebuyer likes to think about: what you want and need in a home.

Well, we’re going to table what you want for now. First, let’s talk about things that you need in a home. Like wants, needs are somewhat subjective. Of course, we all need to buy a home that’s not falling apart. We need to make a good investment in what is probably the largest financial decision we’ll make in our lives. And we need to be somewhere we feel secure.

But what else do you truly need in a home? Here are some questions to consider:

- How long do I plan to stay in this home? (Start here because it will inform your long-term answers to some of the other questions.)

- How many bedrooms and baths do I need?

- What minimum square footage can I live with?

- Do I need central A/C and heat?

- Do I have to have a garage?

- Do I require a single-story home, or will multiple stories work?

- How much storage space do I need, at a minimum?

- How important are the local schools for my needs?

- Do I need additional amenities like a laundry room or a finished basement?

- Must the home be handicap accessible?

- Do I need the home to be move-in ready, or can I deal with a fixer-upper?

- Do my pets or children require a fenced-in yard?

- What additional features or benefits do I consider a requirement?

Here’s a hint: the shorter you keep your list of “needs,” the more options you’ll have to check out. You might just walk into an amazing house you might not have considered with a list of 32 “needs.”

Once you get through your needs, consider your wants. You can use a similar list of questions to figure this out. Wants might include things like particular finishes or layouts, extra rooms like a play area or den, a waterfront property, a great view, or a wood-burning fireplace.

These are not things you have to have to live a good life. But they’d be nice. You can prioritize homes that meet both your wants and your needs. But be sure to think outside the box when you’re looking at homes, too.

7. Get a Feel For Local Real Estate

Once you have your wants and needs list, check out what’s available in your area. It’s fun to browse home sale websites and listings well before you plan to actually buy. This can give you a feel for the areas of town that are most popular, where housing is more expensive, and what you can expect from homes in your area.

Go to open houses. Track home listings and sales. See what features you can get for what price in your area.

Home prices are uniquely local. In my hometown of Indianapolis, two homes situated a few blocks apart could be a $10,000+ difference in the sale price, even if they’re similar in size and amenities. If you’ve never shopped for homes in your area, you may have absolutely no idea what the going rate is.

Looking around can also help you refine that list of wants and needs. Maybe you thought you needed a three-bedroom home. But you find that most of these are well outside your budget for now. So you can decide to scale back to a two-bedroom with a bit less space so that you can afford to buy sooner.

Remember: Your first home isn’t likely to be your last. Don’t be afraid to move into a starter home for now, live in it for a few years, and then shop for something bigger.

8. Figure Out Your Budget

You’d think we’d have talked about budget earlier in this article. But I left it until now for a reason. Until you know what your credit score is, how much down payment you can save, and what real estate prices are like in your area, it’s hard to pin down a budget.

Sure, you may have a ballpark idea of what you can afford to spend. But you could bump your credit score or save a bigger down payment to afford a more expensive house.

To figure out your budget, we’re going to reverse-engineer things a bit. We’ll start by figuring out what you can afford monthly, and then run some calculations to see what you can afford for a total mortgage.

Related: How Big of a Down Payment Do You Need to Buy a Home?

What Can You Afford Monthly?

My number one piece of advice here is this: Don’t listen to the mortgage lender!

Even after they got burned in the housing meltdown, most lenders will give you a bigger monthly payment than you can truly afford comfortably.

For instance, lenders will look at your debt-to-income ratio to determine how high a monthly payment you can handle. This is your monthly minimum debt payment compared with your monthly gross income.

So if you pay a total of $500 towards debt each month and bring home $2,000 per month, your debt-to-income ratio is 25%. Lenders generally prefer that you keep your debt-to-income ratio, including your new mortgage payment, at or below about 36% of your income.

Even though a lender considers a 36 percent ratio to be acceptable, that can be an uncomfortable squeeze for many consumers. When you’re putting more than a third of your monthly income towards debt, that doesn’t leave a lot of wiggle room for emergencies.

So don’t take out a mortgage with a payment this large just because the lender will let you. Instead, look at your budget and decide what you can comfortably pay each month. Consider things like putting money into savings, paying down higher-interest debts, and having some leeway for the unexpected.

Then Decide What You Can Afford Overall

Let’s say you’re comfortable paying $800 per month for your mortgage. This leaves you with a 27% debt-to-income ratio, so you’ve got some room to breathe.

We’ll use the calculator below to show you how this works out. Let’s say you live in Indianapolis and your annual income is $60,000. You saved a $10,000 down payment, and you plan to take out a 30-year mortgage.

You may be able to afford a home worth about $285,000 if you have excellent credit and no monthly debt payments.

Now that you see how it works, you can use this calculator with your ideal mortgage payment, mortgage term, and interest rate. Check out your current potential interest rate before you run the numbers.

Since you already know a bit about real estate in your area, you can now decide if you’re actually ready to buy a home. If this calculation leaves you without any good housing options, you may need to save more money or pay down more debt before you’re ready to buy.

9. Get Pre-Approved for a Mortgage

Now you know you’ve got a good credit score. You have a good down payment. And you have a solid idea of what you can afford to pay for a home. (And you’re not going to let a mortgage lender talk you into a significantly larger mortgage just because you qualify!)

It’s time to get pre-approved for a mortgage. This is really just a process by which you first shop for mortgage lenders and then get preapproval paperwork in hand. This process helps you know, first off, that you’ll qualify for the mortgage you want. Being preapproved can put you in a stronger position when making an offer in a seller’s market. Sellers are more likely to take you seriously when you can prove that you have the financing you need.

Shopping Around for Lenders

You may not have thought about shopping for lenders, but you should. Different lenders will offer you different rates and terms. And this can make a big difference in your overall mortgage payment.

When you apply for a mortgage, a lender is required to give you a Good Faith Estimate. This is an estimate of the total costs of your potential loan. It will include estimates of any closing costs, as well as your APR and monthly payment. Remember that this is just an estimate, but it can still help you shop for the right lender.

Closing costs, especially, can vary dramatically from one lender to the next. So you’ll want to compare the Good Faith Estimates to see where a particular lender might save you money.

Related: Online vs. Traditional Mortgage Lenders

A Note About Mortgage Shopping and Your Credit Score

Shopping around for a mortgage is a good idea. But don’t drag it out too long. Inquiring for new credit–which happens every time you ask a lender to loan you money–can drag down your credit score.

With that said, scorers like FICO know that smart consumers shop around for large loans like their mortgages. So they’ll ignore any inquiries made in the previous 30 days when calculating your score. They’ll also combine applications for the same type of credit from a 14- to 45-day period (depending on the scoring model used) into a single inquiry.

The bottom line is that your best bet is to apply for mortgage preapproval with all your potential lenders within a two-week period. This makes the process less likely to negatively affect your credit score.

10. Start Shopping Around

Once you have a preapproval offer in hand, it’s time to start shopping for your first home. You’ll likely want to have a realtor help with this process. Realtors can help you meet that list of wants and needs while sticking to your budget.

A good realtor should act as your ally in the home search. This person needs to be on your side, listen to what you want, and be willing to work to help you find it.

Once you find a good realtor (ask for recommendations from locals!), stick with that person through the home shopping and buying process.

If you’re finding it difficult to connect with an experienced realtor you can trust, use an online service — such as HomeLight — to guide you.

With HomeLight, it’s easy to find a local agent who knows the market and can provide you with professional service from start to finish. Best yet, the system pairs you with agents based on the analysis of millions of real estate transactions.

As you’re shopping around, remember to keep in mind how well a home suits your needs. And get a feel for how quickly homes are going in your area. If it’s a sellers’ market with homes getting snatched up as soon as they hit the listings, you’ll need to be prepared to make a good offer as soon as you find a home you love.

But if it’s a buyers’ market where real estate is moving slowly, you may have more time to deliberate. And you can often talk a seller down on price, especially if the home has been on the market for several months.

11. Make a Smart Offer

There’s a bit of an art form to making an offer on a home. Offer too much off the bat, and you lose some power of negotiation. Offer too little, and you risk getting outbid.

During the offering process, your realtor should do all the back-and-forth with the seller’s realtor. So be open with your realtor about your limits and expectations.

For instance, maybe you want to mess with absolutely no maintenance or renovations in the first year that you own your home. You find a great little bungalow with a roof that needs replacing and some touching-up that needs to be done in the kitchen. Consider making a higher offer, but ask the seller to fix the home’s issues before you close.

On the flip side, maybe you’re on a tight budget but don’t mind DIYing it a bit in your new home. In this case, ask your realtor to negotiate for a lower price on a fixer-upper. Then you can use some of the money you’ll save on renovations and repairs in your first year in the home.

How Making an Offer Works

The process of making an offer on a home is actually pretty complicated. That’s why I recommend using a realtor when you’re buying your first home.

When you want to make an offer, you put it into writing, and your realtor will deliver your offer. It can include not only your price but also additional terms. For instance, you might ask the seller to pay closing costs or take care of certain renovations before closing.

The seller can then either accept, decline or make a counteroffer. The counteroffer may include a higher purchase price or fewer terms. This back and forth can happen for quite some time until you decide to back out of the process or the seller accepts an offer.

One thing to note is that the offer you make on a house is legally binding for both you and the seller. State and local laws often govern the offer and counteroffer process, and you need to make sure you’re following all of the rules.

If you make an offer and the seller accepts, getting out of that arrangement can be difficult, to say the least. So think carefully, and don’t make any offer you’re not willing to accept, even if you think you can later negotiate a better offer.

The offer can include contingencies. For instance, you might make an offer pending an official inspection of the home. If the inspection turns up major issues, this type of contingency will let you back out, penalty-free. Contingencies can be helpful. But they can also keep the deal from going through, so be careful about them.

The seller’s information in the offer will include disclosures about the house. This can include things like structural issues with the home or hazards in the area. Be sure you read these thoroughly before you sign on the dotted line!

Finally, when you make an offer, know that you’ll have to put some money on the line, most likely. This deposit, which is called earnest money, basically shows the seller that you’re serious. The seller holds this money in escrow until closing. Your offer letter will detail the circumstances under which you could forfeit the money, or when the seller has to return it.

12. Steps After the Offer

You’d think that after you make an offer and the seller accepts, you’ll be closing on your home in no time. But hold your horses. There are actually a few steps you’ll need to follow between the accepted offer and the closing date.

Double Check Your Financing

First, you’ll need to double-check that your financing is ready to go. Even if you’re pre-approved, you’ll have to fill out additional paperwork to actually get the mortgage.

Get Your Home Inspected and Appraised

As part of the process of securing the mortgage, you’ll likely need to have the home inspected. Some lenders require an inspection, though not all do. Still, bringing in a professional who can point out any potential issues with the home is a really good idea.

Your lender may also require that you have a separate appraisal, even if the home seller has already had one done. Oftentimes, you’ll pay for the appraisal and inspection fees as part of your closing costs.

Again, because this process is so complicated and multi-layered, it’s a good idea to work with a licensed realtor who can walk you through all the necessary steps.

Get Homeowners Insurance

Finally, you’ll also need to find homeowners insurance before you’ll be able to close on your home. Lenders want to know that you’re insured from day one, so you’ll need to have insurance before closing. You’ll pay part of your annual insurance fees, along with property taxes, at closing. From then on, part of your monthly payment will go into an escrow account, out of which the lender will pay your insurance and taxes annually.

To make sure you’re getting the best deal (both in terms of dollars AND coverage), you’ll want to compare insurance policies from multiple providers. Shopping around can help you save a lot of money in the long run.

It’s also important to buy the right type of coverage. If you live somewhere that rarely experiences severe weather, like hurricanes, you can probably forego coverage for hurricane-based damage. Using an insurance aggregation site can help.

Lemonade is an insurance company that can help you figure out exactly what coverage you need and will get you one of the best prices possible. When you provide some basic information about your home, Lemonade automatically assesses your property’s risks, such as the risks of fire, theft, or flooding.

Based on this assessment, you can customize the policies you’re looking at to increase the coverage you need and eliminate the ones you don’t. I’ve used the company a few times, both looking for homeowners insurance and renters insurance.

13. Come to Closing Prepared

We already talked about closing costs. And once you have your lender’s Good Faith Estimate, you’ll have a clearer idea of what your closing costs will actually be.

Most of what happens just before closing isn’t your job, other than possibly signing even more paperwork. During this time, the lender may do a title search on the home. This ensures that there are no liens out on the home that someone forgot to pay. The lawyer for the lender will go through the paperwork, and you might ask your lawyer to look it over, as well.

You’ll want to hold off on taking out additional debt during this period. The lender may pull your credit again just before closing. And new debts–or higher revolving debt balances–can mess up your credit and ruin your chances of securing the mortgage.

When you come to closing, your realtor will let you know what you need. But, for the most part, this will be a series of signing a whole bunch of paperwork and writing a fat check for your down payment and closing costs.

Once you get through closing, the home is yours. You’ll usually get the keys at the closing meeting. Then, you’ll want to walk through the property once more within a couple of days of closing, just to ensure that everything is as it should be. If you notice any damage or that changes specified in the contract aren’t complete, your realtor will want to deal with that right away.

Don’t Forget the New Homeowner’s Budget

Finally, you’re ready to move into your new home! But in your excitement, make sure that you don’t forget to change your budget for your new lifestyle of “homeowner.”

Now, you’ll need to make sure to budget for ongoing home repairs, especially the expected sort. For instance, you’ll want to budget for annual or monthly maintenance you need to complete on your home. This includes big jobs like cleaning your gutters as well as small jobs like replacing furnace filters and light bulbs.

You’ll also need to budget for new furniture and decor, especially if you’re upgrading to a larger space. But the necessities come first, so keep living out of boxes and with your old furniture while you bulk up your savings!

Frequently Asked Questions (FAQ)

Do I Really Need 20 Percent Down to Buy a House?

While you can put down as little as 3 or 3.5 percent to buy a home, there’s a reason this is a popular rule of thumb. A higher down payment means less debt and you can avoid private mortgage insurance. However, if you can’t afford 20 percent down, you can make a smaller down payment and still get into a house.

How Do I Know How Much Home I Can Afford?

Determine what you can pay each month and go backward from there to determine how big a mortgage you can afford. In general, you want to keep your debt-to-income ratio below 36 percent. You might be more comfortable with a lower ratio, though.

However, it’s important to consider your other home costs, not just the principal and interest. Also consider home insurance, property taxes, utilities, and maintenance costs. Your mortgage payment plus other costs should be something that you can comfortably pay each month. Some homebuyers like to keep their costs to no more than 30 percent of their income, while others are comfortable with 25 percent. Figure out what’s comfortable for you.

How Long Should I Stay in a Home?

In general, buying a home is likely to work best for those who plan to stay in their homes for at least five to seven years. However, depending on your situation and the local market, the numbers might work out for a shorter time period.

Is It Better to Buy a Home or Rent?

Whether it’s better to buy or rent depends on your individual situation and goals. There’s no right answer. Review your own preferences and financial situation. In some cases, it can make sense to rent and put your resources elsewhere. In other circumstances, it might make more sense to buy a home.

When is the Best Time to Buy a House?

There is no best time to buy a home. You can try to time the market in terms of prices and interest rates, but the reality is that the market can change. Instead, focus on your own lifestyle and financial goals, as well as affordability. If you can find a good deal, and it fits your own situation, that’s the best time to buy a house.

Final Thoughts on How to Buy Your First Home

Buying your first home is a significant life and financial milestone. It can also feel like a daunting task. Because it’s such a large purchase and commitment, it’s important to carefully consider your situation and prepare ahead of time. Make sure you’re really ready to move forward with homeownership before you commit the funds. By thinking through your individual needs and wants, as well as saving up and positioning your finances, you can successfully get through the transaction and make the most of your money.